On a domestic level the price of lamb is not sustainable.

While supermarkets and butchers won't be passing on the full price rise that we have seen at farm level, domestic consumption will slow.

With supply unlikely to improve for some time, the question is whether export markets can sustain the high prices.

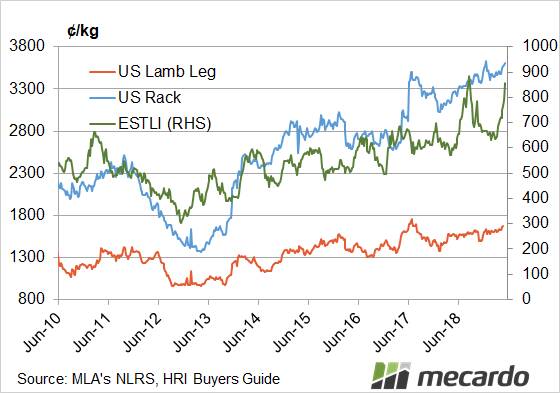

It seems exporters are competing strongly with trade buyers for lambs ranging from 22-28 kilograms cwt. The east coast heavy lamb indicator was quoted last week at 912 cents, relative to an Eastern States Trade Lamb Indicator (ESTLI) of 880c.

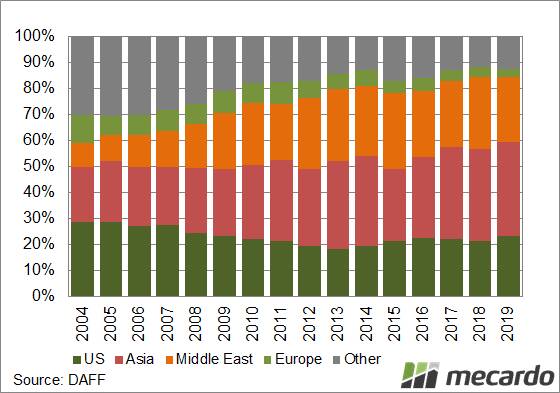

The US is one of our biggest lamb markets, so far this year taking 23 per cent of our export lamb (Figure 1). As such, US wholesale lamb prices and their trends provide some insight to how much exporters might be able to pay.

The wholesale price of US legs of lamb and racks of lamb have been trading in a range on an upward trend (Figure 2). The US leg and rack prices aren't quite at record highs, but they are not far off.

US wholesale lamb prices have improved since saleyard lamb prices peaked in August last year. The US leg has gained 7pc and the rack 6pc. Does this mean lamb prices are going to peak 6pc higher than last year? Not necessarily, but rising wholesale prices in the US market are only good news for a higher peak than last year.

What does it mean?

Exports markets look like they will help drive saleyard lamb prices to new highs over the coming months but for average prices to reach $10, lamb importers might have to pay a bit more.

A 6pc rise on last year's peak still 'only' puts the ESTLI at 930c.

The increased demand from China for lower value cuts might help push values higher, as they move towards being our biggest export market.

The sustainable level of prices is yet to be found but the higher the market goes, the higher the base becomes.